There are various an effective way to prevent being required to take out a short-term pay day loan. A lot of people consider you can get a hold of a number of many from cash without providing financing. We understand it is never ever simple to score that  loan, specifically having less than perfect credit if any credit score. Capture payment loans as an example. Did you know all the cost lenders will require a credit score that must definitely be expert? They generally speaking deny Texans that have best that you mediocre borrowing from the bank too. It is comparable whenever being qualified getting a payday loan from inside the Tx. It used to be a posture where borrowers could seek out its financial or any other credit supply so you can secure a preliminary-title mortgage.

loan, specifically having less than perfect credit if any credit score. Capture payment loans as an example. Did you know all the cost lenders will require a credit score that must definitely be expert? They generally speaking deny Texans that have best that you mediocre borrowing from the bank too. It is comparable whenever being qualified getting a payday loan from inside the Tx. It used to be a posture where borrowers could seek out its financial or any other credit supply so you can secure a preliminary-title mortgage.

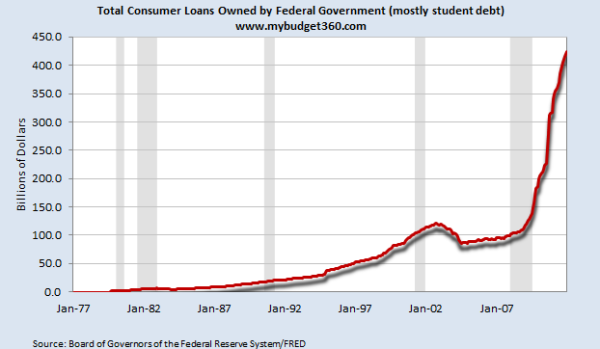

Simply over about ten years ago Texas customers had way more discretionary earnings and they you are going to give currency to help you members of the family and you may household members effortlessly. Toward most recent economy, days past is actually gone. Very version of pay day loan was possible for most customers with nowhere else to turn. These people become seniors that are into a fixed income including normal consumers with an urgent requirement for financing.

There are numerous statewide training that demonstrate Colorado payday loan complete an incredible importance of those with no place otherwise to show. In several area aspects of the state, for example Dallas and Houston you will find those who merely don’t have offers. While it’s best to avoid applying for payday loans or payment loans from inside the Texas, these types of citizens simply have nowhere otherwise commit. A lot of people during the components such as Houston and you may Dallas don’t have a lot of financial possibilities and it’s very hard to save money if it is currently rigid. Away from Texas people inside problem, you can find individuals who is generally best off not using having businesses that render payday loans for the Colorado.

We like to trust that individuals exactly who get on the internet pay-day finance when you look at the Colorado provides no place otherwise to show. While you are in times in which you you would like an enthusiastic on line loan within the Tx you need to basic get a hold of what is leftover in deals before you apply to own an on-line mortgage. This is because, this type of money enjoys grand rates of interest and perhaps they are most designed for owners that are for the a would like of short-term financial support. When there is no bank account and cash set aside to have problems then you may has nowhere else to turn besides taking a cash advance. That does not mean you need to move ahead that have any mortgage bring without knowing brand new Texas pay day loan laws and regulations. Once you’ve paid down the fresh Colorado payday loans we recommend creating an entire budget investigation. This includes taking time and energy to break apart wherever your money is certian and you will where you could slashed expenditures in order to create your bank account.

Solutions to help you payday loans for the Tx!

Did you know really Texans have little to help you no cash accessible to him or her into the offers if they have a financial crisis? This is the form of situation which leads anybody along the road regarding in need of an online payday loan. There are numerous studies done for the past long-time which show very consumers never even have a few hundred cash from inside the savings! We recommend usually developing an intend to save money monthly. No matter if it is simply $10 or $20, it will make sense quickly. There are numerous financial institutions and you may credit unions all over which declare that can help build a family savings. A beneficial location to check for a financial otherwise credit commitment would be the Colorado Service away from Financial.

Consider credit cards pay day loan as the that loan alternative

Luckily that Tx users can merely avoid being in times regarding economic stress. Because of the planning ahead and creating a spending plan dysfunction many people is to manage to slim money that might be or even saved. If you which having an issue of weeks if not weeks you’ll encounter a number of currency leftover from inside the discounts. Several other caveat of having a checking account is the fact financial institutions tend to pay attention with the hardly any money on membership. Pricing are extremely lower today, so that you have many payday loans solutions, however, you never know how much cash prolonged which can history! Meaning people offered a payday loan during the Houston whom saved and you will budgeted will not you would like that loan! This is the better condition when it comes down to people, let alone a man which is for the a fixed money! Tx pay day loan commonly bad, however, there are many other options that can help you save money in the end. With the help of our resources, you might avoid needing to score a cash loan or installment financing and keep more of their hard-acquired money!

Neueste Kommentare